pa local services tax refund application

Local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest andor penalties for local tax filings and payments that are made on or before May 17 2021 which is the extension for filing federal and. Only non-resident employees are eligible for a refund based on work performed outside of.

Your Social Security number.

. Get free help applying for public benefits. Pittsburgh PA 15219 Ph. We can also identify appropriate tax treatment that is consistent with good business practices and states applicable tax laws and rules.

546 Wendel Road Irwin PA 15642 Ph. Low-Income Pennsylvanians May Be Missing Out on PA Tax Refunds of 100 or More. Tax and accounting experts who specialize in helping individuals and small businesses meet their US.

This booklet provides Pennsylvania farmers and those selling to farmers a guide to the application of sales and use tax. You can use your tax software to do it electronically or use IRS Form 8888 Allocation of Refund PDF including Savings Bond Purchases if you file a paper return. Open a safe and affordable bank account.

It is not mandated that a nonprofit organization be qualified by the federal government in order to be eligible for a PA. A completed Application for Sales Tax Exemption REV-72. Services for taxpayers with special hearing andor speaking needs are available by calling 1-800-447-3020 TT.

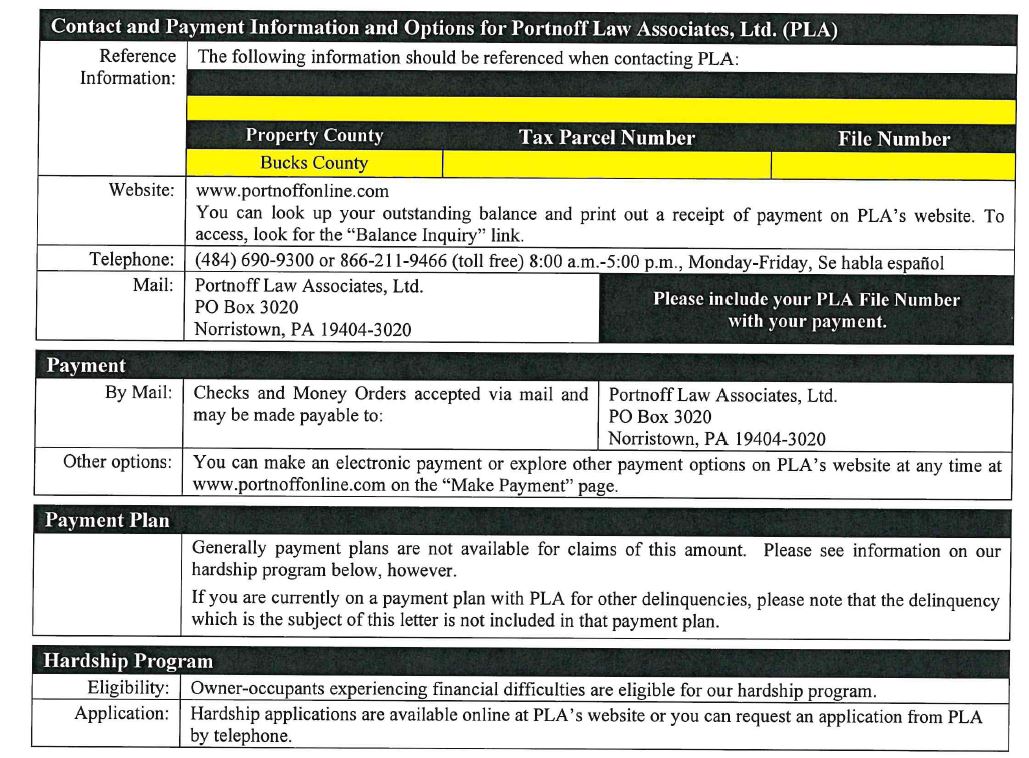

Appeal a water bill or water service decision. Any claim for refund must be filed within three years from the date the tax was paid or due whichever date is later. Payment HAB-EIT PO Box 25158.

February 22 2022 Harrisburg PA There are more than 118000 low-income Pennsylvanians who may be missing out on state tax refunds of 100 or more the Department of. RefundCredit HAB-EIT PO Box 25160 Lehigh Valley PA 18002. The Township Tax Office is responsible for the collection of the mercantilebusiness privilege taxes and the local services tax.

Enroll in direct deposit as a vendor or a foster parent. PO Box 559 Irwin PA 15642 Form LST22r21 LocaL ServiceS Tax refund appLicaTion Name Address CityState Zip Tax Year SSN Phone Multiple Employers Income exemption for Local Services Tax is 12000 or less from all sources of earned income and net profits when the LST tax rate exceeds 10 per year. Check the status of your Pennsylvania state refund online at httpswwwmypathpagov.

If the refund status has not changed. WwwPA100statepaus 2 CUSTOMER SERVICES TAXPAyER ASSISTANCE. If you or your spouse are expecting a refundcredit please mail to.

Get Real Estate Tax relief. The amount of your requested refund. Salaried employees can use these forms to apply for a refund on Wage Tax.

Get free financial counseling. Attach copys of final pay statements from employers. Your refund status will be updated daily.

Refunds for taxes paid to local jurisdictions. Earned Income Local Services Taxes Earned income and local services taxes are collected by Keystone Collections. V Tax Filing is a firm of US.

About V Tax Filing. Whether you need to file a personal or. Petition for a tax appeal.

Specific questions on statutory interpretation in this booklet may be addressed to the Office of Chief Counsel PA Department of Revenue PO BOX 281061 Harrisburg PA 17128. The tax office also receives monies for deposit from various departments for such services as issuing permits recreation fees inspections refuse police etc. You can also use our online refund forms for faster and more secure processing.

PwCs State and Local Tax SALT practice can help you with strategies to manage your state and local tax issues by recommending solutions that are consistent with your companys overall business objectives. Your local earned income tax withheld should be reported in the box labeled Local Income Tax What address do I send my return to. If you are living in a CityCounty which is subject to file a tax return we at V Tax Filing file your citylocal taxes for Free of cost.

866-539-1100 Keystone Collections Group has opened a new phone line dedicated exclusively for taxpayer inquiries during the tax filing season. The Local Services Tax LST for cities in Pennsylvania is withheld on a mandatory basis from the salaries of employees whose duty stations are located in the cities listed below. You will be prompted to enter.

If you are not required to file IRS 990 your organizations year-end treasurers report. You can use the form to buy the Treasurys popular I Bonds whose returns are adjusted for inflation and will yield 712 percent through April after which the yield will be reset to another inflation-based. DCED lacks the legal authority to extend the statutory local filing and payment deadline of April 15.

Get a tax account. If you are making a payment please mail to. A copy of your bylaws or articles of incorporation including a dissolution statement.

Taxes are due and payable as prescribed by law whether or not a tax bill has been.

Tax Collection Warminster Township

California Tax Forms H R Block

Faqs On Tax Returns And The Coronavirus

Guide To Local Wage Tax Withholding For Pennsylvania Employers

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

3 11 3 Individual Income Tax Returns Internal Revenue Service